Short Read :

YNAB is a paid app designed to assist individuals with managing their finances by creating a detailed budget and allocating every dollar earned to a specific bucket. It has all the essential features that a budgeting app.

Supported Platform

Android

IOS

WEB

APPLE WATCH

ALEXA

Price: $99 USD/Year, first 34 days free.

Key Features:

- You have the option to connect your bank accounts, or you can manually input transactions if you prefer.

- Prioritize budgeting over just tracking expenses.

- You can create categories from scratch using the highly flexible user interface.

Detailed Read

Before diving into how YNAB can help you manage your finances, it’s important to understand the benefits of budgeting apps like YNAB.

If you’re currently struggling with any of these issues, a budgeting application could prove to be immensely beneficial

- Are you struggling with managing your finances?

- Are you living paycheck to paycheck?

- Have you gone over budget almost all the time?

- Keen on controlling the money and not money controlling you?

- Not interested in maintaining day-to-day accounts manually or through a semi-automated solution like Excel or Google Sheets etc.

There are several free budgeting apps available in the market. However, it is crucial to conduct a thorough analysis of YNAB’s product features before making any final decisions on alternative solutions. By doing this, we can evaluate the features offered by our competitors in comparison to YNAB.

What is YNAB (You Need A Budget)?

This app is designed to assist individuals with managing their finances by creating a detailed budget and allocating every dollar earned to a specific bucket. Budgeting is the key in YNAB. Forsee all the expenses and plan them clearly. Although it comes at a cost and may be more expensive than other similar apps, it provides numerous features that can aid in saving money, reducing debt, and planning for the future.

YNAB Key Features and Benefits

| Below is the list of essential features of Personal Finance Software Does YNAB have It? | |||

| Expense Tracking | Yes | Security | Yes |

| Income Tracking | Yes | Mobile Accessibility | Yes |

| Budget Creation | Yes | Data Export | Yes |

| Expense Categories | Yes | Debt Tracking | Yes |

| Bill Reminders | Workaround | Investment Tracking | Yes |

| Goal Setting | Yes | Tax Planning | Yes |

| Financial Reports | Yes | Multi-Currency Support | Workaround |

| Transaction History | Yes | User-Friendly Interface | Yes |

| Bank Account Integration | Yes | Customization | Yes |

| Manual Transaction | Yes | Savings Goals | Yes |

| Customer Support | Yes | Collaboration | Yes |

| Below is the list of essential sub-features of Personal Finance Software Does YNAB have It? | |||

| | |||

| Net Worth | Yes | Planning Different Scenarios | No |

| Budget Calendar | Yes | Flexible budgeting (Any date range) | Yes |

| Label Transactions automatically | Yes | Create Custom Dashboards/Reports | Yes |

| Transaction Search | Yes | Cashflow Forecasting | Workaround |

| Migrating from Other Budget Apps | Workaround | ||

YNAB sets itself apart from other budgeting software as it focuses on the present and future, not just the past. Instead of simply reviewing your expenses at the end of the month, YNAB encourages active planning and tracking throughout the month, allowing you to maintain control over your costs. Other budgeting apps have a cashflow forecast feature but YNAB wants you to plan it clearly in your budget by foreseeing the expenses.

When it comes to budgeting, YNAB stands out among other personal finance apps for its hands-on approach. Users play an active role in maintaining their budgets and can benefit from spending time reviewing and categorizing their finances through the platform. YNAB’s budgeting tool follows four rules to help users better manage their money.

Every Dollar Counts

Embrace Your True Expenses

Roll with Punches

Age Your Money

1: Every Dollar Counts

Organizing your expenses by allocating each dollar to a specific category can help you manage your spending effectively. You Need A Budget follows a digital zero-based budget approach where you distribute all your earnings towards bills, debts, and savings until you have nothing left to allocate. This method helps you avoid unnecessary spending and focus on essential expenses. By referring to your budget plan, you can make informed spending decisions without worrying about overspending.

2: Plan a Year Ahead and save every month for that expense

With YNAB, you can plan for expenses that don’t happen often, like surprise presents or house taxes. The app allows you to create different savings categories and gradually fill them each month to avoid getting into debt. YNAB promotes budgeting for these expenses and allocating funds to pay for them every month. You can calculate your annual spending on X, divide it by 12, and allocate it monthly. As the year progresses, you’ll be funding your X budget and using the money as necessary.

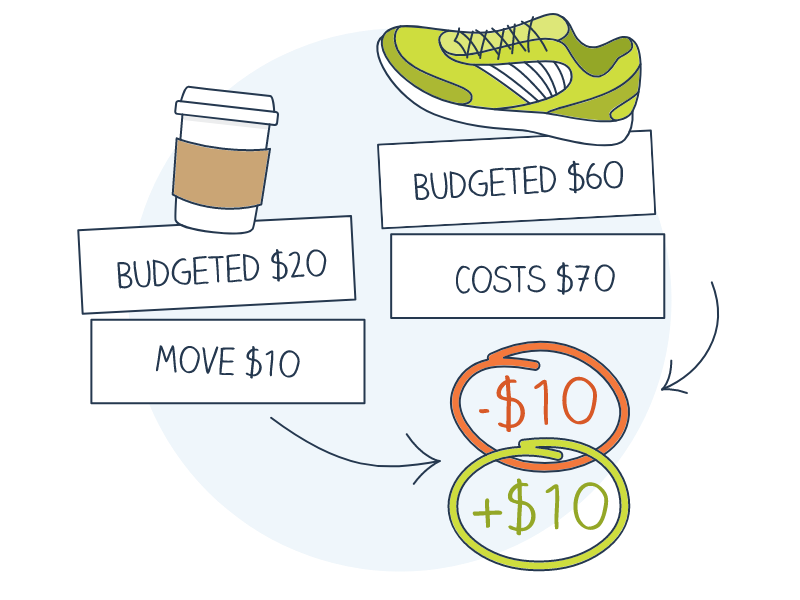

3: Move the money from one category to another

To manage overspending, you can adjust your budget categories. If you spent more than planned on one category, you can free up money from another category and move it to the overspent one. YNAB doesn’t have set rules or budgets, allowing flexibility to move money around as needed. Unexpected expenses and overspending in certain categories may occur, but YNAB encourages you to keep going by simply moving money from one category to another.

4: To get started on achieving your goal, it can be helpful to create a buffer.

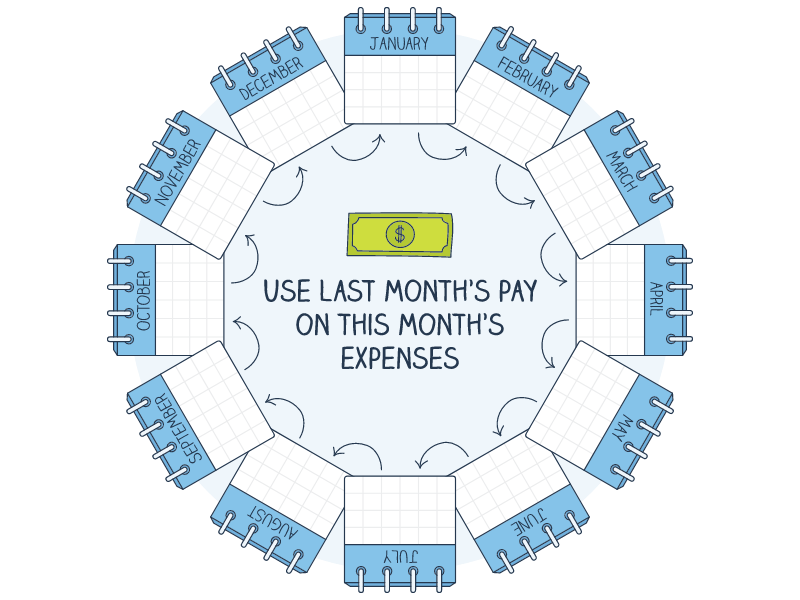

Welcome to a place where you can manage your monthly expenses using last month’s income. This method is the opposite of living from one paycheck to the next. The goal is to have a buffer of 30 days, allowing you to age your money. By using last month’s income, you can cover expenses for the next 30 days. This means that you won’t have to stress when there are delays in your cash flow.

Other Notable Features

- Real-time syncing and mobile access

- Debt payoff tools

- Savings and investment tracking

- Reports and analytics

Getting Started with YNAB

Getting started with YNAB is easy – just follow these 3 simple steps.

- You have two options: create a new user ID and password, or log in using your existing Google or Apple account.

- Upon creating an account, populate the numbers for each line item per category on the dashboard’s first screen.

- Link your bank account to the platform. Most major banks are compatible.

My advice would be to do the following before even going to step 2.

- Take some time to come up with a future plan. Determine your goals and start with 2-3 simple ones that can be built upon later.

- Begin with an emergency fund as your first goal, then move on to other goals based on your thought process.

- Jot down upcoming or future expenses for the next 12 months.

- Learn about investing, retirement savings, and other financial matters. Dedicate an hour each day to reading articles or watching videos related to finances and improving your plan based on others’ input. Keep learning!

- When creating a budget, be honest with yourself and don’t put off any financial tasks for later.

- Tools can automate tedious tasks, such as syncing your bank transactions to your YNAB account. You don’t have to use the categories that YNAB provides by default. Instead, organize the categories to match your monthly spending habits. Remember, every dollar counts!

YNAB Pricing and Plans

YNAB Offers a free trial for 34 days(No Credit card Required!!). Annual pricing is about $99 USD Yearly + Tax (Taxes are not charged if you are outside the USA). Students can avail 34-day free trial + a free one-year subscription. Please refer to the website YNAB for the updated pricing.

YNAB vs. Competitors

Comparing YNAB with others would be an exhaustive topic which I would cover in a separate article. Maybe I will pick only the top 3 in this segment and start comparing them in the other article. The key selling point for YNAB is to control your spending rather than identifying what you have spent at a later point in time.

Conclusion and Final Thoughts

YNAB is a well-thought-out product that serves the purpose of managing money. The question we need to ask ourselves is, are we ready to adapt to the budgeting habits? I personally would do it for my future.